The top questions answered to assist businesses looking at operating in Australia

Your guide to doing business in Australia

Australia is a popular country for overseas businesses to operate in. It is the 14th largest economy in the world, has a highly educated workforce, and is rated 14th in the World Bank’s Doing Business Index for ease of doing business.

Australia is a common law country. Companies are subject to Federal corporate law, although states may also determine laws that apply to businesses operating in that state. Income tax is applied at the Federal level, as is GST. There is no income tax or sales tax at a state level. The main state tax that applies to businesses is payroll tax, which is a tax imposed by states on the total wages a company pays.

Top 12 doing business in Australia questions:

- 1. What type of entity should I use?

- 2. What registrations will I need?

- 3. What tax rates apply?

- 4. What lodgements will I need to submit?

- 5. Will I be subject to income tax?

- 6. Will I need to pay GST?

- 7. What are an employer’s employee related obligations?

- 8. Will I need to get an audit?

- 9. What incentives are available?

- 10. What tax planning should I consider?

- 11. What are the foreign investment restrictions?

- 12. What are the special rules for larger multi-nationals?

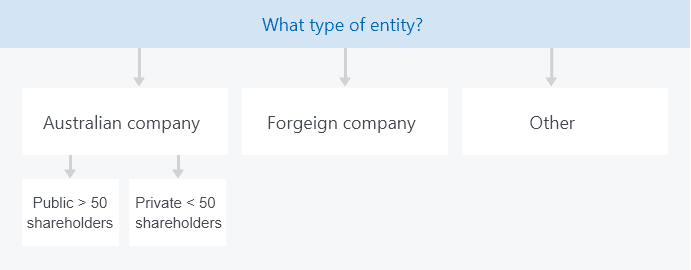

1. What type of entity should I use?

As a foreign investor, there are several important considerations when deciding how to establish a business in Australia. Although Australia has various types of structures available for establishing a business, the most common types of entities used by foreign investors operating in Australia are a private company (Pty Limited), or a branch of a foreign company. With each different type of entity comes different legal and tax implications that investors need to consider…

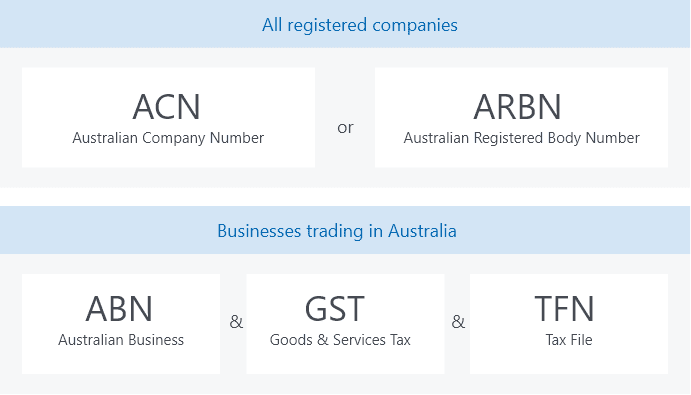

2. What registrations will I need?

The registrations required will depend on the type of entity. All Australian-registered companies will have an Australian Company Number (ACN), whereas Australian branch operations will usually require an Australian Registered Body Number (ARBN). All entities operating a business will require an Australian Business Number (ABN)…

3. What tax rates apply?

The general company income tax rate in Australia is 30%. However, small-to-medium companies are taxed at 25%…

4. What lodgements will I need to submit?

Key tax lodgements include an annual income tax return and a periodic (monthly, quarterly or annual) activity statement to report PAYG withholding and GST, income tax instalments, Fringe Benefits Tax instalments and some other taxes…

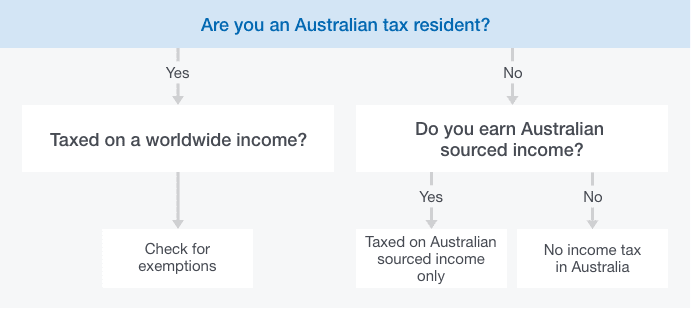

5. Will I be subject to income tax?

All Australian registered companies will be subject to income tax on their worldwide income. This is subject to some exemptions for income derived from foreign subsidiaries and branch operations (a participation exemption)…

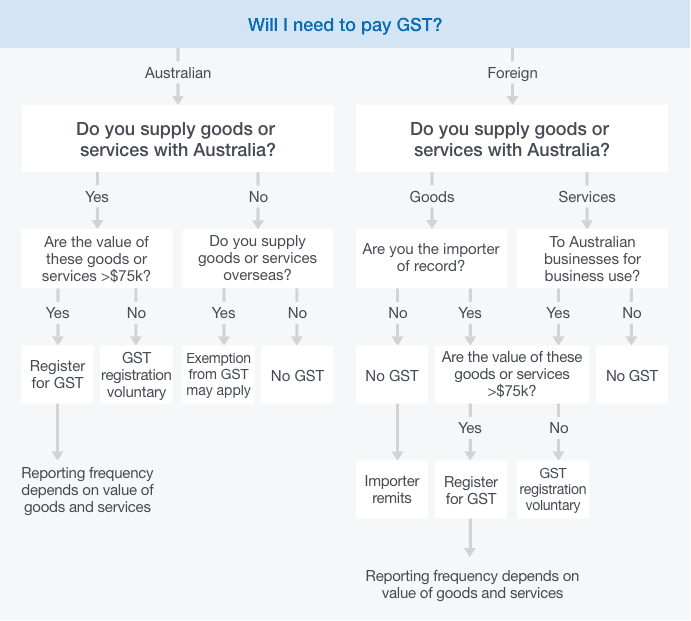

6. Will I need to pay GST?

GST is a broad-based consumption tax that applies to the supplies of most goods and services. The GST rate is 10%. Businesses are required to remit GST to the ATO on supplies they make and are generally entitled to claim a credit for GST included in the price of acquisitions…

7. What are an employer’s employee-related obligations?

If an employer is going to have employees in Australia, either local hires or expatriates, a series of tax and other obligations will arise…

8. Will I need to get an audit?

Australian registered companies must prepare audited annual financial statements and lodge these with ASIC if the company is a large proprietary company. Small Australian owned proprietary companies do not need an audit…

9. What incentives are available?

The Research and Development Tax Incentive is available to Australian companies conducting experimental research and development activities that may benefit the wider Australian economy…

10. What tax planning should I consider?

Australia has strong transfer pricing laws and robust general anti-avoidance provisions, so much of the tax planning that may be appropriate in other jurisdictions will not be appropriate in Australia…

11. What are the foreign investment restrictions?

Australia has limited restrictions on foreign investment and no exchange controls. The main limitation is on non-residents acquiring real property in Australia, where approval by the Foreign Investment Review Board may be required…

12. What are the special rules for larger multi-nationals?

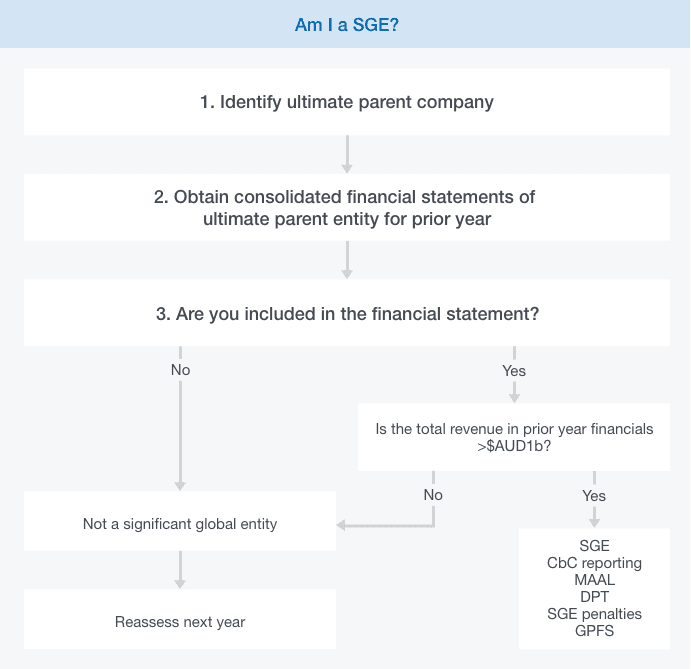

Australia has implemented Country by Country Reporting (CBCR) for large multinationals operating in Australia. Entities part of an accounting consolidated group with more than A$1bn in global annual turnover…

1. What type of entity should I use?

As a foreign investor, there are several important considerations when deciding how to establish a business in Australia. Although Australia has various types of structures available for establishing a business, the most common types of entities used by foreign investors operating in Australia are a private company (Pty Limited), or a branch of a foreign company. With each different type of entity comes different legal and tax implications that investors need to consider.

Establishing an Australian company

The most common structure used by foreign investors to conduct business in Australia is an Australian private company, a ‘Pty Limited’ company.

An Australian private company is a separate legal entity that is required to be registered with the Australian Securities and Investments Commission (‘ASIC’). When registered, each company is issued with a unique Australian Company Number (‘ACN’).

A private company:

- Is limited to 50 non-employee shareholders.

- Cannot engage in fundraising activities.

- Must have at least one director who resides in Australia. If a Secretary is appointed, the Secretary must also reside in Australia.

- Must have a registered office in Australia and appoint a resident public officer to deal with the Australian Taxation Office.

- Has various annual reporting obligations. However, these will vary depending on the size of the private company.

- Can be 100% foreign-owned.

- Has a minimum number of one shareholder/s and no restriction on the number of shares that can be issued.

- Is governed by the Corporations Act 2001 (Cth) (‘Corporations Act’).

The restrictions on shareholders and fundraising do not apply to a public ‘Limited’ company. A private company can be converted to a public company if needed.

Each Director of an Australian company is required to apply for and receive their Australian Director ID from the Australian Business Registry Services. For non-resident Directors, this process can take 2-3 months and is likely to slow the timeline for incorporation of the Australian company.

Once all the necessary information is gathered, an Australian company can be registered with ASIC within one business day. Additionally, incorporating an Australian company does not require an attorney.

Establishing a foreign branch

A foreign company may choose to carry on a business in Australia itself. This is known as establishing a foreign branch.

Where a foreign company chooses to carry on a business in Australia itself, it must be registered as a foreign company under the Corporations Act. The foreign company must apply to ASIC to register an Australian branch. Upon registration, a unique Australian Registered Body Number (‘ARBN’) will be provided to the Australian branch.

As with the Australian subsidiary, the Directors of the foreign company are required to obtain Australian Director ID’s prior to registering the foreign company in Australia. This process can take 2-3 months and must be completed prior to lodgement of the application to register a foreign company with ASIC. The ASIC registration process can take up to four weeks to process, provided all the necessary documentation is provided to ASIC.

As with Australian companies, a foreign company establishing a branch in Australia must have a registered office in Australia and must appoint a resident public officer. The company must also appoint a local agent responsible for compliance with the Corporations Act.

Once registered as an Australian branch, the foreign company must lodge its annual Financial Statements with ASIC and comply with specific reporting requirements.

Operating through an Australian branch does not create a separate legal entity, as is created when a private or public company is incorporated.

Alternatives available

Other types of structures are available in Australia and may be appropriate in particular circumstances.

A trust is a common form of business structure used in Australia by smaller, privately owned businesses.

Trust income is generally taxed in the hands of the beneficiaries each income year.

In Australia, trusts are governed by common law and contract law. Establishing a trust does not require an attorney.

For foreign investors, trusts (mostly unit trusts) are generally used for property investments in Australia.

There are also specific entity structures available for venture capital investments and managed investments.

2. What registrations will I need?

The registrations required will depend on the type of entity. All Australian-registered companies will have an Australian Company Number (ACN), whereas Australian branch operations will usually require an Australian Registered Body Number (ARBN). All entities operating a business will require an Australian Business Number (ABN).

There are also a variety of business and tax registrations which may also be required as a result of conducting business in Australia, such as registrations for:

- A Tax File Number

- Goods and Services Tax

- PAYG Withholding

- Fringe Benefits Tax, and

- Payroll Tax.

Corporate Registrations

All Australian registered companies will have an Australian Company Number (ACN) issued by the Australian Securities and Investments Commission (ASIC). Branch operations in Australia will usually require an Australian Registered Body Number (ARBN).

Business and tax registrations

All businesses operating in Australia are required to have an Australian Business Number (ABN) issued by the Australian Taxation Office (ATO). On average, the ATO will take up to two weeks to process registration for an ABN, except where non-resident entities or individuals are involved. In these cases, additional identity verification processes apply, which can extend the processing time of applications.

Other business registrations may be required, such as GST and PAYG Withholding, which can be obtained at the same time as or separately from the ABN application.

A GST registration is required for businesses with a GST turnover (typically the annual business turnover) of $75,000. However, a business can also choose to register for GST voluntarily.

A PAYG Withholding registration is required to remit tax withheld from payments to employees, other workers and businesses that do not quote their ABN. Registration is required prior to the first payment you are required to withhold.

Businesses will also be required to register with the ATO for a Tax File Number (TFN) for income tax purposes.

Employers who provide certain non-cash benefits to employees will also be required to be registered for Fringe Benefits Tax. Fringe benefits could include provision of entertainment (such as staff social functions), provision of a motor vehicle, payment of private expenses, provision of rent-free accommodation and interest free loans. An employer is required to be registered if they are liable for FBT.

Payroll tax is a state tax, and employers are required to register in each state/territory where they are liable for payroll tax. The tax is determined based on the employer’s total Australian taxable wages (including non-cash benefits).

There are also specific lodgement obligations with respect to these tax registrations. Please refer to section four, ‘What lodgements will I need to submit?’ for further details.

3. What tax rates apply?

The general company income tax rate in Australia is 30%. However, small-to-medium companies are taxed at 25%.

Companies are required to pay their income taxes in instalments throughout the year, either monthly or quarterly.

There are also withholding tax obligations on dividends, interest, and royalties paid to foreign residents. Such withholding tax applies to dividends generally at 0% or 30%, interest at 10% and royalties at 15%. However, these rates may be reduced by tax treaty arrangements.

Most sales in Australia are subject to GST of 10% of the value of the sale. However, sales that qualify as being GST-free or input taxed are exempt from GST.

Australia has a progressive personal income tax system, with rates ranging from 0% to 47%.

Corporate tax

The general company tax rate in Australia is 30% unless the company is a small-to-medium company.

A company is generally a small-to-medium company if its annual turnover is less than $50m. Small businesses are currently taxed at 26%, with the tax reducing to 25% by FY22.

Withholding taxes

Withholding tax applies to dividends, interest and royalties paid to foreign residents. The withholding tax rates are generally 0% or 30% for dividends, 10% for interest and 15% for royalties. Tax treaty arrangements between Australia and the foreign resident’s country may reduce these rates.

The 0% dividend rate applies to dividends from ‘tax-paid’ profits, which are termed ‘franked’ dividends.

Goods and Services Tax (GST)

The GST rate in Australia is 10% of the value of the sale. This rate applies to all sales made in Australia unless they are GST-free or input taxed. Sales that qualify as GST-free or input taxed are exempt from GST.

GST is generally payable by the supplier and is included in the price of the goods or services being supplied.

Fringe Benefits Tax (FBT)

Fringe benefits tax is a tax payable by employers based on the value of non-cash benefits provide to employees. The FBT year applies from 1 April to 31 March. The fringe benefits tax rate is currently levied at 47% of the grossed-up value of the fringe benefits provided during the FBT year. In principle, the ‘gross up’ takes the cost of the benefit and grosses it up to the equivalent pre-tax income that an employee would have needed to earn to be able to have acquired the same benefit.

There various FBT exemptions and concessions available.

Payroll Tax

Payroll tax is levied in all states/territories in which the employer pays taxable wages, including non-cash benefits, above the relevant threshold.

Each state/territory has its own payroll tax rates and annual thresholds which vary year-on-year. The payroll tax for each state is on average 5% of the taxable wages exceeding the annual threshold. The thresholds vary from state to state, with the lowest being $650,000 in Victoria and the highest being $2,000,000 in ACT.

Payments to independent contractors are usually considered ‘taxable wages’ for payroll tax purposes.

4. What lodgements will I need to submit?

Key tax lodgements include an annual income tax return, and a periodic (monthly, quarterly or annual) activity statement to report PAYG withholding and GST, income tax instalments, Fringe Benefits Tax instalments and some other taxes.

Australian registered companies are required to notify ASIC of changes in their registration details and pay an annual fee. Foreign companies may also need to lodge audited financial statements.

Large entities that are part of a group with an annual global turnover of AU$1 billion or more will also be subject to additional reporting requirements under the CbC reporting regime.

Branches with an ARBN will need to lodge their parent entity’s annual financial statements with ASIC.

There are other lodgement obligations that can arise in specific situations.

Income tax

Whether you have set up a private company, public company or branch of a foreign entity in Australia, you will be required to lodge an annual income tax return.

The default reporting date is for the year ended 30 June. This can be changed on application to the ATO, for example to align with a foreign parent company’s year end.

Income tax returns are due on the 15th day of the seventh month after year end, for 15 July for a 31 December year end. Extended due dates are provided for 30 June year ends.

Activity statements

Activity statements are forms that taxpayers must submit to the ATO to report on various tax obligations, including:

- Goods and Services Tax (GST)

- Pay As You Go (PAYG) Withholding

- PAYG Instalments (income tax)

- Fringe Benefits Tax (FBT) instalments

- Wine Equalisation Tax (WET), and

- Luxury Car Tax (LCT).

If an entity is registered for GST, the reporting and payment cycle of activity statements will vary based on its GST turnover:

- Monthly: GST turnover is $20 million or more

- Quarterly: GST turnover is less than $20 million, and you have not been advised by the ATO that you must report monthly, or

- Annually: GST turnover is less than $75,000.

If you are uncertain whether you will need to register for GST, please refer to section two, ‘What registrations will I need?’.

Similarly, PAYG Withholding reporting and payment cycles will depend on whether entities are ‘Small Withholders’, ‘Medium Withholders’ or ‘Large Withholders’, resulting in quarterly, monthly or twice weekly lodgement obligations, respectively.

PAYG instalments are paid monthly for large taxpayers and quarterly for most smaller taxpayers. FBT instalments are also generally paid quarterly.

Additional lodgements for employers

Where an entity has employees, a number of lodgement obligations will arise.

Employers who provide certain non-cash benefits to employees will be required to lodge a Fringe Benefits Tax (FBT) return with respect to each FBT year (1 April to 31 March).

Payroll tax is a state tax imposed when wages paid by employers exceed specified threshold amounts. Payroll tax obligations vary between states and territories in terms of applicable thresholds, which also vary from state to state, with the lowest being $700,000 in Victoria and the highest being $2,000,000 in the ACT.

Employers are also required to collect pay-as-you-go (PAYG) Withholding on amounts paid to employees. Where an employer is registered for PAYG Withholding, they must report the total amounts withheld in their activity statements (refer to the ‘Activity statements’ section above).

Employers are also obligated to report employee salaries and wages, PAYG Withholding and superannuation contributions through Single Touch Payroll (STP). Employers are required to utilise STP-enabled payroll or accounting software, which will automatically report this information to the ATO whenever payroll is run. STP is not required to be on a specific cycle and will follow the employer’s pay cycle.

Significant global entities

Entities that are part of an accounting consolidated group with more than AU$1 billion in global annual turnover are considered a “significant global entity” (SGE).

SGEs are subject to an additional reporting obligation collectively referred to as Country-by-Country reporting.

SGEs will be required to lodge the following documents that contain detailed information regarding the entity’s international related party dealings:

- CbC report

- Master file, and

- Local file.

SGEs will be subject to significant penalties of up to AU$ 782,500 for late lodgement of any tax obligations, not only those specifically applicable to SGEs.

Please refer to section 12 ‘What are the special rules for larger multi-nationals?’ for more information on SGEs.

Audited financial statements

Large proprietary companies are required to lodge audited financial statements, prepared in accordance with approved accounting standards, with ASIC.

A company is classified as large if it meets two of the following three criteria:

- Consolidated gross operating revenue more than $50 million a year

- Consolidated gross assets more than $25 million at year end, and/or

- Number of employees at year end is more than 100 for that entity and all controlled entities.

The proprietary company is otherwise categorised as small.

Small foreign-controlled companies are required to prepare an audited financial report for lodgement with ASIC unless they obtain one of the following exemptions:

- Where their results are included in a consolidated financial report lodged with ASIC by a registered foreign company or an Australian company, or

- Where the company obtains relief from ASIC within three months prior to the commencement of the financial year or within four months of the end of the relevant year.

Please refer to section eight, ‘Will I need to get an audit?’ for more information on audited financial statements.

5. Will I be subject to income tax?

All Australian registered companies will be subject to income tax on their worldwide income. This is subject to some exemptions for income derived from foreign subsidiaries and branch operations (a participation exemption).

Branches of foreign companies will be subject to income tax on the profits from the Australian branch if they have a permanent establishment in Australia based on Australia’s domestic laws and any relevant tax treaty arrangement.

Assessable income

As a general rule, Australia will tax all Australian residents on their worldwide income and capital gains. Australian resident taxpayers include:

- Companies registered in Australia

- Companies that are registered overseas, but have their central management and control in Australia

- Trusts that have an Australian resident trustee at any time during the income year

- Trusts that have their central management and control in Australia at any time during an income year, and

- Individuals who are residents of Australia for tax purposes.

Certain types of income derived by Australian resident companies will be exempt from income tax. For example, exemptions from Australian income tax may apply to:

- Dividends received from wholly owned subsidiaries

- Profits of a foreign branch / permanent establishment of the Australian company, and

- Capital gains from the sale of shares in wholly owned foreign subsidiaries.

For non-residents, Australia will tax:

- All net profits that are “attributable” to an Australian branch. These are generally the profits derived from the activities carried out by the branch in Australia, and

- Any Australian sourced income.

If income that is taxed in Australia is also taxed in a foreign country (i.e., there is a double tax), Australia has a foreign tax offset system that may reduce the tax payable in Australia. If there is a double tax treaty between Australia and the country that has also levied tax on the relevant income, the treaty may provide some relief from double tax.

Treatment of tax losses

Losses that an Australian taxpayer derives from trading may be carried forward indefinitely. These carried forward losses of a taxpayer may be offset against future operating profits of that taxpayer if they can pass certain tests. The tests that apply vary depending on what entity the taxpayer is.

For example, companies need to pass one of the following tests:

- The continuity of ownership test – broadly this requires that the same individuals have a majority ultimate beneficial ownership interest in the company from the start of the year that the losses are first incurred, until the end of the year in which the losses are applied, or

- The business continuity test – this requires that a company be carrying on the ‘same’ or a ‘similar’ type of business in the year that it intends to recoup the losses as it did just before it failed the continuity of ownership test.

The test that a trust must pass to apply carried forward losses varies depending on the type of trust.

A fixed trust must pass the ‘50% stake test’ and the ‘income injection test’. A non-fixed trust must pass the ‘control test’ and the ‘patterns of distributions test’ in addition to the 50% stake test and the income injection test.

6. Will I need to pay GST?

GST is a broad-based consumption tax that applies to the supplies of most goods and services. The GST rate is 10%. Businesses are required to remit GST to the ATO on supplies they make and are generally entitled to claim a credit for GST included in the price of acquisitions.

A tax invoice needs to be issued for supplies that are subject to GST. A tax invoice is an invoice that includes specific details set out in the GST law.

There are special rules for international transactions, including the import or export of goods, services supplied to non-residents and inbound supplies of intangibles (such as software) by non-residents to Australian entities.

We recommend seeking specific advice on the GST implications of cross-border transactions, including with related parties.

General GST matters

GST is payable on ‘taxable supplies’. To constitute a taxable supply, the supply must be:

- For consideration

- Made during the furtherance of an enterprise

- Connected with Australia, and

- Made by a supplier who is registered or required to be registered for GST.

A key consideration for overseas businesses transacting in Australia or with Australian customers is whether the supply is ‘connected’ with Australia.

The supply of goods will generally be connected to the jurisdiction where the goods are supplied. Care needs to be taken when importing goods to Australia as the importer of record will also carry the GST obligations on import.

Real property will relate to the jurisdiction in which it is located.

Services will generally be connected to the jurisdiction where the people rendering the services are located. If these people are in Australia, the supply will relate to Australia.

For non-residents making supplies of services to Australian GST registered businesses, an automatic reverse charge arrangement can apply to shift the GST obligations to the Australian business.

Registered entities will obtain a credit for GST paid on most acquisitions where the items acquired are used in the course of their business.

A registered business must lodge GST returns either monthly or quarterly via a BAS. The net GST liability (GST payable, less GST input tax credits) is paid to the ATO at the same time.

Some supplies, such as financial supplies and residential rent, are ‘input taxed’. Input taxed supplies are not subject to GST. However, the supplier is not entitled to a refund of the GST paid on acquisitions related to making these supplies.

There is also a limited range of GST-free supplies where GST is not required to be charged. For example, supplies of certain food, as defined in the GST Act, are GST-free. Unlike input taxed supplies, a supplier of GST-free supplies can claim input tax credits for GST paid on acquisitions acquired to make GST-free supplies.

For entities registered for GST, a ‘tax invoice’ with the required information must be issued for each taxable supply. There are specific requirements relating to currency conversions where the consideration is denominated in a foreign currency.

There are no state-based sales taxes.

Import and export

GST is payable on the importation of goods. The Australian Border Force acts as a collection agent, and for goods greater than A$1,000, the GST needs to be paid when goods are ‘entered for home consumption’ in Australia.

Where the imported goods are to be utilised in a business, a GST registered business will generally be entitled to claim a credit for the GST paid on importation. Subject to meeting specific eligibility criteria, a business can register for the ‘GST Deferral scheme’ that allows it to defer paying the GST on importation until lodgement of the Business Activity Statement, where a corresponding credit is then claimed, thereby removing the cashflow impact of GST on importations.

Export sales are generally GST free provided they are exported within 60 days. Likewise, services supplied for consumption outside of Australia are generally GST-free. We recommend that the terms of trade for such supplies, such as incoterms and the recipient of the supply, be reviewed to ensure that the requirements for GST-free treatment are met.

E-commerce

GST is also levied on ‘low value’ imported goods, goods valued at A$1,000 or less. Unlike goods above A$1,000, where the importer of record is required to pay the GST, the liability on low value goods is imposed on the supplier of the goods or the owner of the electronic distribution platform through which low value goods may be sold where the supplier makes greater than A$75,000 of such sales into Australia. An exception may apply where the goods are supplied to Australian entities registered for GST.

There are also specific rules on the application of GST to inbound intangible supplies, including digital supplies such as software downloads, SAAS, online streaming, etc. GST is levied on B2C intangible supplies where the customer is located in Australia but not on B2B, that is, GST registered customers’ intangible supplies, on the rationale that the business would claim a corresponding input tax credit, so the transaction is revenue neutral.

Registration options

Two registration options are available to non-resident businesses. ‘Simplified registration’ allows businesses to remit the GST they have charged to the ATO, but they are then unable to claim input tax credits for acquisitions they make. To claim credits, the business needs to complete the normal GST registration process, which involves being issued an ABN. This may also be appropriate for non-residents who are making significant acquisitions from Australia that are subject to GST. In the absence of registering, the GST would be an unrecoverable cost.

It may be possible for a non-resident to enter into an optional reverse charge agreement with an Australian customer to shift the GST obligations to the customer. This does not change the customer’s overall GST position and removes the obligation for the non-resident to register for GST.

GST reporting

GST is reported to the ATO on the monthly, quarterly or annual Business Activity Statement. Payment is also made at this time.

For more information on BASs, please refer to section four, ‘What lodgements will I need to submit?’.

7. What are an employer’s employee-related obligations?

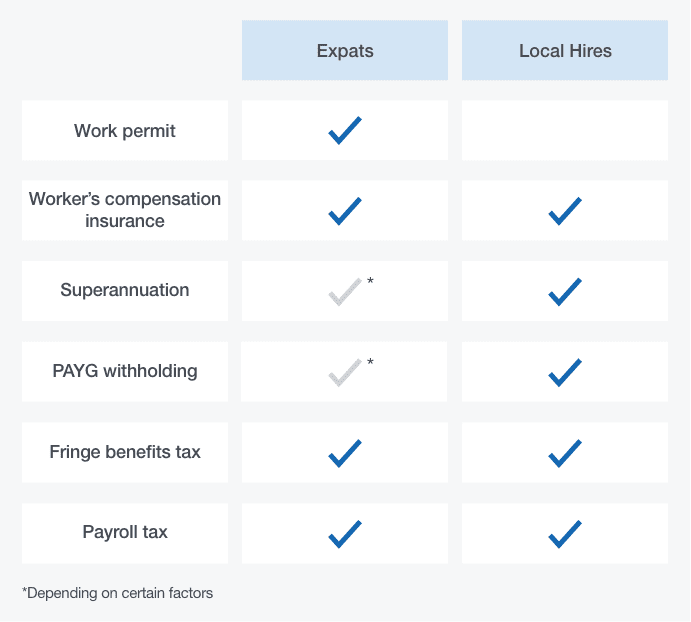

If an employer is going to have employees in Australia, either local hires or expatriates, a series of tax and other obligations will arise.

Tax (termed PAYG Withholding) is required to be withheld from employee payments. There are some exceptions, such as when the employee is satisfied with the short stay exemption in a tax treaty.

Superannuation (pension) contributions are required to be made by an employer on behalf of the employees. From 1 July 2024, this is set at 11.5% of remuneration as a minimum. Some expatriate employees may be exempt from the Australian superannuation system.

Non-cash benefits provided to employees, such as health insurance, accommodation, use of a car, entertainment, etc., may be subject to a fringe benefits tax (FBT), which is imposed on the employer.

A state-based payroll tax is payable if salary and wages paid to employees in that state exceed a threshold. The thresholds vary from state to state, with the lowest being $900,000 in Victoria and the highest being $2,000,000 in ACT from 1 July 2024.

Employers will also likely require a workers’ compensation insurance policy in each state where they have employees.

Expatriate employees will require a special visa to work in Australia. The visa classes vary depending on the role, industry and duration of the stay, amongst other factors.

Australia has strong employment laws and engaging an Australian employment law specialist to assist with drafting or reviewing employment contracts is recommended.

PAYG withholding

Employers are required to register with the ATO for PAYG Withholding. Employers will withhold and subsequently remit to the ATO a portion of the salary paid to employees. The tax collected by the employer is known as Pay as You Go (PAYG) withholding. An employer will be subject to penalties for failing to withhold and remit the appropriate level of PAYG tax or for late payment of PAYG tax to the ATO.

At the end of each financial year, an employer is required to provide an income statement, reported to the ATO electronically, which shows the employees’ gross salary, how much PAYG was withheld and other specific payroll related items. The income statement is available through MyGov or the ATO app.

Employers are also obligated to report employee salaries and wages, as well as PAYG Withholding and superannuation contributions through Single Touch Payroll (STP). Employers are required to utilise STP-enabled payroll or accounting software that will automatically report this information to the ATO whenever payroll is run. STP is not required to be on a specific cycle and will follow the employer’s pay cycle.

Superannuation Guarantee Charge (SGC)

Employers are required to contribute a prescribed minimum level of superannuation support for each of their employees in each quarter. The minimum contribution is currently 11.5%, from 1 July 2024, of an employee’s ordinary times earnings, including commissions, bonuses and allowances. The minimum contribution will increase to 12% progressively over the coming years.

Employers must make the superannuation contributions within 28 days of the end of each quarter and notify their employees within 30 days of their contributions being made.

If an employer sends an Australian employee to work overseas temporarily, the employer must continue to pay super contributions in Australia for them. The overseas country may also require an employer to pay super or an amount equivalent to super. However, Australia has bilateral agreements with some countries that would exempt an employee from paying the super in that overseas country.

In the alternative, an employer may not need to pay superannuation contributions in respect of expatriate/non-resident employees where their country of residence has entered into a specific bilateral social security agreement with Australia.

If an employer fails to pay the required amount, they are subject to a superannuation guarantee charge (SGC), which is paid to the ATO and the superannuation payment becomes non-tax deductible.

Fringe Benefits Tax (FBT)

Where an employer provides non-cash benefits to an employee, their family or other associates of that employee, FBT may need to be paid by the employer with respect to those benefits. Examples of fringe benefits include allowing an employee to use a car for private purposes, paying an employee’s gym membership and reimbursement of private expenses incurred by an employee.

Employers must self-assess the amount of FBT they have to pay and lodge an FBT return at the end of each FBT year, that is 1 April to 31 March. When working out their FBT liability, employers will need to ‘gross up’ the taxable value of benefits provided to their employees.

For example, the FBT on a GST free expense paid on behalf of an employee (e.g. health insurance) of $1,000 would be $886 ($1,000 x 1/(1- 47%) x 47%). The reason for the gross up of the benefit is that the employee on the top marginal tax rate must earn $1,886 to have a net income of $1,000 after income tax of $886 ($1,886 x 47%) to pay for the benefit if it came out of their salary.

In effect, employers pay the employee’s income tax on fringe benefits, assuming that the top marginal tax rate applies. Accordingly, before negotiating an employee’s package, you should ensure that you are aware of the full cost of the package, including FBT, to the employer.

There are limited opportunities to package expatriate employee’s remuneration, including some concessionally taxed benefits, to minimise FBT and income tax.

Payroll tax

An employer may also be required to pay payroll tax in respect of payments to their employees.

Salary and wages, bonuses, some allowances, the taxable value of fringe benefits and superannuation contributions are all ‘taxable wages’ for payroll tax purposes. Payments to independent contractors are also subject to payroll tax unless an exemption applies.

The payroll tax rates and thresholds differ depending on the laws in each state and territory. The payroll tax for each state is, on average, 5% of the taxable wages exceeding the annual threshold. The thresholds vary from state to state, with the lowest being $900,000 in Victoria and the highest being $2,000,000 in ACT from 1 July 2024.

Each state and territory has grouping rules, which operate to group ‘connected’ entities so that they are not able to access multiple payroll tax thresholds across the states and territories.

Workers' compensation insurance

Employers are required to carry workers’ compensation insurance for their employees with respect to work-related injuries. Once a business employs staff in Australia, workers’ compensation insurance must be taken out in each state/territory where the company has employees. The cost of this insurance will range from 1% to 10% of payroll costs, depending on the nature of the business.

Work permits and visas

An expatriate travelling to Australia for business purposes must obtain appropriate employment authorisation (Temporary Skill Shortage (TSS) Visa subclass 482).

In March 2018, the TSS Visa replaced the 457 visa and introduced new requirements including tightened English language requirements and a requirement for applicants to have at least two years’ experience in their skilled occupation.

The TSS Visa replaced the 457 visa and introduced new requirements, including tightened English language requirements and a requirement that applicants have at least two years’ experience in their skilled occupation.

The TSS Visa allows an expatriate to work in Australia for:

- Two to four years (under the Short-term stream), and

- Up to four years with the possibility of applying for permanent residency (under the Medium-term stream).

There is an additional stream called the ‘Labour Agreement’ stream, which applies where the employer has a labour agreement with the Australian government and allows an expatriate to work in Australia for up to four years.

Obtaining temporary work authorisation under the TSS Visa involves a three-step process:

- A sponsorship application by the employer

- A nomination application for a skilled position by the employer, and

- A visa application by the proposed employee.

Nominations:

- Are restricted to a list of occupations that is significantly smaller than the list of occupations approved under the previous 457 Visa

- Extend to activities in regional areas including occupations relating to farming and agriculture, and

- Must meet salary and employment condition related requirements.

The necessary applications are lodged and processed in Australia with the Department of Home Affairs. Prior to lodgement, it is necessary to gather all the relevant documentation relating to the application. The usual time to assemble the documentation is approximately three to four weeks.

Once the application is lodged with the Department of Home Affairs, the processing time frame can be up to twelve weeks, however processing times may vary depending on the stream. Complete nomination applications are likely to be processed more quickly. Incomplete applications might be delayed or refused after two days if there is insufficient information provided to demonstrate that requirements are met.

This application process is normally undertaken in conjunction with a visa/migration specialist advisor.

A visa holder cannot change conditions of employment without prior approval from the Department of Immigration.

Terms of employment

Australia’s industrial and workplace relations laws have undergone significant change in recent times through government initiatives designed to make the labour market more flexible and efficient. In establishing a presence in Australia, care should be taken to ensure that any terms of employment are in accordance with the relevant Australian legislation.

We recommend that employment contracts be reviewed by a specialist employment lawyer to ensure compliance with Australian legal requirements.

What issues should an expatriate employee consider?

Income tax

For Australian tax purposes, individuals living and working in Australia will be categorised as either ‘resident’ or ‘non-resident’. The imposition of tax on an individual will differ depending on their tax residency status.

The most fundamental distinction is that a resident will be subject to Australian income tax on their worldwide income, including capital gains, whilst a non-resident is subject to Australian income tax on Australian sourced income only. Further, resident individuals will be entitled to the tax-free threshold; however, they will also be liable to pay the 2% Medicare levy.

Expatriate employees may be classified as temporary residents regardless of whether they are a ‘resident’ or ‘non-resident’ under the general rules. Temporary resident status offers significant Australian tax concessions to expatriate employees as they will generally only be taxed in Australia on their Australian sourced income and all remuneration regardless of its source for employment/personal services rendered, together with capital gains on ‘taxable Australian property’ (TAP) while they are a temporary resident. TAP consists principally of Australian real estate or assets deriving their value from Australian real estate.

Individuals should review their personal investments and other income sources and assets prior to becoming a resident (or ceasing to be a resident) of Australia. In addition, individuals should review their personal circumstances and take tax advice before applying for permanent resident status or Australian citizenship, as they will lose the valuable tax concessions provided to temporary residents. This will help them determine the potential tax exposure of a change in tax residency and establish whether there are any planning opportunities.

Work permits and visas

An expatriate travelling to Australia for business purposes must obtain appropriate employment authorisation (TSS Visa). The process for obtaining this type of visa is outlined above.

Expatriates moving overseas should also consider whether they need to obtain a similar work permit or visa to work in the foreign country of their choice.

Private health insurance

Expatriate employees may not be eligible for medical cover under the National Medicare Scheme while working in Australia.

Australia has health care agreements with some countries. These countries are the United Kingdom, New Zealand, Italy, Netherlands, Malta, Sweden, Ireland, Belgium, Slovenia, Norway and Finland. Residents of these countries are entitled to limited access to Medicare, but only in emergency situations.

It is, therefore, necessary for expatriates on temporary business visas to consider taking out private health insurance to cover themselves in the event of sickness or a medical emergency, even if partial health cover is available via one of the health care agreements mentioned above. Sometimes, this is a requirement for obtaining a visa.

There are various private health funds operating throughout Australia that provide such insurance.

Medicare levy surcharge (MLS)

Resident individuals are liable to pay a Medicare levy based on the amount of their taxable income for the income year. The Medicare levy rate for the 2019/20 year is 2% of taxable income.

Individual taxpayers on higher incomes who do not have adequate private patient hospital insurance for themselves and their dependants may be liable for an additional Medicare levy surcharge of 1%, 1.25% or 1.5%, depending on their income level. For instance, individuals who earn over $97,000 in the 2024/25 income year and do not have private health insurance are potentially liable for the MLS. Higher thresholds apply where dependants are involved.

If an individual cancels their private health insurance when moving overseas, they may still be liable for the MLS if they remain an Australian resident and their income exceeds the relevant threshold. In these circumstances, the individual should contact their health fund to determine whether any savings in premiums from cancelling or suspending health cover would outweigh the potential MLS payable.

Superannuation

When expatriates move overseas, their superannuation in Australia will remain subject to the same rules even if they are leaving Australia permanently. This means they will not be able to access their superannuation until they reach their preservation age and retire or satisfy another condition of release.

If an expatriate is planning on moving permanently or indefinitely to New Zealand, they may be able to transfer their super to a New Zealand KiwiSaver scheme from a participating Australian super fund.

An individual moving to another country may be able to secure the release of their superannuation, but a tax liability will arise.

8. Will I need to get an audit?

Australian registered companies must prepare audited annual financial statements and lodge these with ASIC if the company is a large proprietary company. Small Australian owned proprietary companies do not need an audit.

A company is a large proprietary company if it meets two of three criteria: employing more than 100 full-time equivalent employees, having $50M or more annual turnover and having $25M or more gross assets.

Foreign-owned companies are required to prepare audited annual financial statements and lodge them with ASIC. However, foreign-owned companies that are also small proprietary companies can apply to ASIC for an exemption.

The large proprietary tests

The reporting requirements of proprietary companies and registered foreign companies depend on whether the company is defined as large or small under the Corporations Act.

A company is classified as large if it meets two of the following three criteria:

- It has a consolidated gross operating revenue of more than $50 million a year

- It has consolidated gross assets of more than $25 million at year end, and/or

- Its number of employees at year end is more than 100 for that entity and all controlled entities

The proprietary company is otherwise categorised as small.

The Corporations Act sets out the requirements for a company to prepare a financial report for lodgement with ASIC and the need to have the report audited. Once lodged with ASIC the financial report is available to the public.

Special rules for foreign owned companies

Small foreign controlled companies are required to prepare an audited financial report for lodgement with ASIC unless they obtain one of the following exemptions:

- Where their results are included in a consolidated financial report lodged with ASIC by a registered foreign company or an Australian company, or

- Where the company obtains relief from ASIC within 3 three months prior to the commencement of the financial year, or within four months of the end of the relevant year.

Accounting records

The Corporations Act requires records to be kept for seven years from the date of the transaction.

Where statutory accounts are not required the directors are still required to maintain accurate accounting records to explain the company’s financial transactions and financial position and to enable statutory accounts to be prepared if required. Management accounts are necessary for tax and management purposes and to allow the directors to monitor compliance with their fundamental obligation under the Corporations Act to ensure the company can meet its debts as and when they fall due.

A company must have a fixed accounting period of 12 months except in the first year or for a transitional year in which the balance date changes.

The default balance date is 30 June, but this can be changed, for example, to align with the parent company’s year-end.

9. What incentives are available?

The Research and Development Tax Incentive is available to Australian companies conducting experimental research and development activities that may benefit the wider Australian economy. Companies that satisfy the eligibility criteria may be entitled to a cash refund of up to 43.5% of the costs incurred in conducting the R&D activities.

The Accelerating Commercialisation Grant can provide Australian businesses with up to AUD $1 million of matched funding to take a novel product, process or service to market. Unlike the R&D Tax Incentive, this is a competitive grant with a limited number of applicants approved each year.

Most States provide incentives for businesses to employ new workers. Depending on the size of the business, the incentive could be a cash rebate or a reduction of the business’ overall payroll tax liability.

The Export Market Development Grants (EMDG) scheme encourages export-ready Australian businesses to increase international marketing and promotion expenditure by reimbursing up to 50% of eligible expenses such as marketing consultants, trade fairs, advertising and marketing visits.

Depending on the business’ size, location, and industry, numerous other federal and state government grants and incentives may be available.

R&D Tax Incentive (R&DTI)

The R&DTI is available to Australian companies conducting experimental research and development activities that may benefit the wider Australian economy. To qualify, the company must be conducting at least one “core R&D activity” during the year that demonstrates the following:

- The aim of the activity is to generate new knowledge in the form of new or improved products, processes or services.

- The outcome of the activity could not have been known in advance of conducting the activity, and

- A systematic progression of work based on the principles of established science.

For companies with an aggregated turnover of less than AUD $20 million, the incentive is in the form of a 43.5% refundable tax offset. For all other companies, the tax offset is 38.5% and non-refundable.

The R&DTI is jointly administered by the ATO and AusIndustry. Claimants self-assess their eligibility and are required to keep detailed records of their R&D activities conducted during the year.

There are additional measures for Australian subsidiaries conducting R&D activities on behalf of a foreign parent company.

Industry Growth Program (IGP)

The IGP provides Australian businesses with up to AUD $5 million of matched funding to commercialise a project in one of the following seven priority areas as identified by the Australian government:

- Value-add in resources

- Value-add in agriculture, forestry and fisheries

- Transport

- Medical science

- Renewables and low emissions technologies

- Defence capability

- Enabling capabilities including AI, quantum computing, robotics, biotech and advanced manufacturing

Unlike the R&D Tax Incentive, this is a competitive grant with a limited number of applicants approved each year.

Other incentives

Most States provide incentives for businesses to employ new workers. Depending on the size of the business, the incentive could be a cash rebate or a reduction of the business’ overall payroll tax liability.

The Export Market Development Grants (EMDG) scheme encourages export-ready Australian businesses to increase international marketing and promotion expenditure by reimbursing up to 50% of eligible expenses such as marketing consultants, trade fairs, advertising and marketing visits.

Depending on the business’ size, location, and industry, numerous other federal and state government grants and incentives may be available.

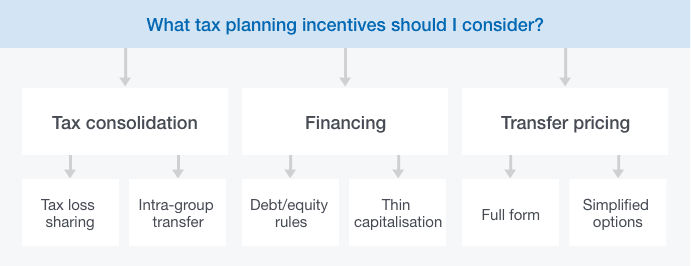

10. What tax planning should I consider?

Australia has strong transfer pricing laws and robust general anti-avoidance provisions, so much of the tax planning that may be appropriate in other jurisdictions will not be appropriate in Australia.

Nevertheless, overseas businesses should consider:

- The ideal structure to repatriate profits in a tax-effective manner

- The mix of debt and equity used to fund the Australian operations, as this will have an impact on the amount of interest expenses that can be claimed as a tax deduction, and

- Forming a tax consolidated group so that multiple entities operating in Australia can be treated as a single taxpayer, enabling the sharing of tax losses and facilitating intra-group transactions.

Tax consolidation

The tax consolidation regime allows wholly owned Australian group companies (together with eligible trusts and partnerships) to consolidate for tax purposes.

Entry into the tax consolidation regime is not compulsory, but very limited group relief is available for groups that choose to remain outside of it.

The rules may also apply to wholly owned Australian subsidiaries of a foreign parent even when the Australian subsidiaries may not themselves be part of an Australian wholly owned group of companies (i.e. the foreign parent has direct investment into two or more Australian subsidiaries). Such a scenario is referred to as a ‘multiple entry consolidated’ (MEC) group.

Entities that are part of a consolidated group are treated as one entity for income tax purposes and will lodge one income tax return that covers all members of the group. This will allow the losses of one group member to be offset against the assessable income of another entity within the group

Transactions between entities that are part of the same consolidated group are effectively ignored for income tax purposes.

However, entities that form part of a consolidated group for tax purposes are still separate legal entities. As such, they are still required to maintain separate accounts, records etc.

It should be noted that GST, FBT and PAYG Withholding tax are not included within the tax consolidation regime and will continue to be the responsibility of the individual entities in the group.

Separate grouping rules are available for GST.

Certain ‘tax cost setting’ calculations may be required upon forming a tax consolidated or MEC group and when new entities join an existing group. Preliminary calculations may be required before making a decision regarding tax consolidation.

Financing - debt vs equity

When reviewing your financing of the Australian operations, consideration should be given as to whether you wish to finance the entity with equity or debt. This decision is usually made in conjunction with the thin capitalisation rules outlined below.

When the funding of an entity will occur in part with debt, care should be taken to ensure that the debt instrument, like a loan, will meet the tax definition of ‘debt’.

Factors such as the applicable interest rate (or interest free nature of the loan), term of the loan and existence of other debt or equity instruments can impact the classification of the loan. If a loan is determined to be equity, any interest will be treated as a dividend and not deductible.

Thin capitalisation

The thin capitalisation rules operate where the amount of debt used to finance Australian operations exceeds certain limits. The rules can operate to disallow a proportion of the finance charges (e.g. interest) attributable to the Australian entity. If the entity is part of a tax consolidated group, the tests are applied to the overall group.

Australia has recently introduced significant changes to its thin capitalisation rules. These rules, which will apply to income years beginning on or after 1 July 2023, have resulted in a change from the 60% debt to assets ratio ‘safe harbour’ test to a profits-based test.

Under the new rules, the tests that can be applied for thin capitalisation purposes are:

- The Fixed Ratio Test—Under this test, an entity’s net debt deductions are capped at 30% of its tax earnings before interest, taxes, depreciation, and amortisation (EBITDA). This is the default test.

- The Group Ratio Test—The group ratio test considers a multinational corporation’s worldwide financial position. This test limits net debt deductions by calculating a ratio of the worldwide group’s net third-party interest expense and EBITDA, which can be found in the group’s financial statements.

- The Third-Party Debt Test—Under this test, only debt deductions attributable to external debt are allowed, while deductions associated with related-party debt are denied.

However, the thin capitalisation rules do not apply to disallow any debt deduction if the total debt deductions of that entity and all its associate entities for that year are below AU$2 million.

This allows entities with ‘debt deductions’ (being interest and other debt costs) of less than $2 million to claim a tax deduction for the debt deductions without having to satisfy any of the thin capitalisation tests.

Another key change in Australia’s thin capitalisation regime is that the quantum of debt now needs to be tested using transfer pricing rules to ensure adherence to the arm’s length principles, which was not the case under the previous thin capitalisation regime. This essentially means that, notwithstanding the thin capitalisation limits, the ATO may challenge related party debt arrangements where the quantum of debt is not commercially supportable through the application of the transfer pricing provisions.

Further, there is a new integrity rule (the debt deduction creation rule) that applies to income years commencing on or after 1 July 2024 (which do apply to pre-existing arrangements). Under the debt deduction creation rules, interest incurred on debt used for certain purposes is disallowed in full. This would include debt that has arisen through related party restructures or acquisitions or debt used to fund distributions made within the group.

Using an Australian holding company

Australia provides a number of exemptions for Australian holding companies with foreign investments and income.

An Australian holding company will generally not be taxable on the capital gain made on the sale of a foreign subsidiary. The Australian holding company would also not be taxable on dividends paid by the foreign subsidiary. By using the conduit foreign income mechanism, these foreign dividends can be passed through the Australian holding company to a foreign shareholder without triggering Australian income tax or withholding tax liabilities.

A non-resident shareholder in an Australian company is generally not taxable on any gain made on the sale of the company’s shares.

Non-residents are subject to Australian capital gains tax only where the assets are interests in Australian real property, or the business assets of Australian branches of a non-resident. Australian CGT also applies to ‘indirect Australian real property interests’, being non-portfolio interests in interposed entities (including foreign interposed entities), where the value of such an interest is wholly or principally attributable to Australian real property.

‘Real property’ for all these purposes is consistent with Australian treaty practice and extends to other Australian assets with a physical connection to Australia, such as mining rights and other interests related to Australian real property.

A ‘non-portfolio interest’ is an interest held alone or with associates of 10% or more in the interposed entity.

This means that only the sale of shares in a ‘land-rich’ Australian company would give rise to an Australian capital gains tax liability for a non-resident shareholder.

This should be contrasted to the situation of an Australian branch, where any gain on the sale of the Australian branch’s assets will be subject to tax in Australia.

Transfer pricing

Australia applies transfer pricing provisions which are based on the OECD guidelines.

The legislation seeks to ensure that Australian businesses deal with international related parties on arm’s length terms and conditions.

These provisions apply to all Australian businesses, regardless of the type of entity used. It therefore applies equally to an Australian branch of an overseas company (treated as a separate taxpayer) and an Australian subsidiary.

The Australian transfer pricing rules provide the ATO with broad powers to notionally reconstruct a taxpayer’s financial results and provide a legislative basis for applying ‘profit based’ approaches to calculate transfer pricing adjustments.

The key features of the Australian transfer pricing rules can be summarised as follows:

- It is a requirement to prepare contemporaneous transfer pricing documentation to support that international related party transactions have been conducted on arm’s length terms. Penalty protection will not be available if there is not contemporaneous documentation in place.

- Taxpayers that have international dealings with related parties that are more than $2 million need to lodge an International Dealings Schedule (IDS) with their annual income tax return The IDS is a detailed form requiring full disclosure of all international related party transactions, the main transfer pricing method that is applied to each transaction, along with a disclosure as to the level of specific transfer pricing documentation held for that transaction or dealing.

- Simplified transfer pricing documentation options are available to taxpayers with lower value and low risk international dealings where specific eligibility conditions are met.

- The ATO is relatively sophisticated in the transfer pricing area and, in the last decade, has implemented several programs which target taxpayers in a particular sector or with certain attributes. It does not only focus on large corporations but also has an active interest in the small to medium enterprise (SME) area.

- The ATO’s current focus areas are arrangements involving intangibles, including mischaracterisation of payments made for intangibles and migration of intangibles outside Australia, and cross-border financing arrangements.

The ATO is limited to a seven-year review period when making a transfer pricing adjustment. It is, therefore, in a taxpayer’s interest to ensure that its international related party dealings are conducted at arm’s length and that supporting documentation has been prepared and maintained from the outset.

11. What are the foreign investment restrictions?

Australia has limited restrictions on foreign investment and no exchange controls.

Under the Foreign Acquisition and Takeovers Act 1975 (Cth) (FATA), certain investments by foreign persons, foreign owned corporations, or foreign governments may be restricted or subject to approval from the Foreign Investment Review Board (FIRB). FIRB examines foreign investment proposals and advises the Treasurer on the national interest implications. The Treasurer is responsible for making decisions on whether or not to approve foreign investment proposals. Generally, the Treasurer has 30 days to decide and the applicants will be informed of the decision within ten days of it being made.

The restrictions and thresholds vary, depending on the type of investment, the relevant industry, the percentage of the asset or interest to be acquired, the dollar amount proposed to be invested and the identity of the foreign investor.

Some common investments that are subject to approval include:

- Acquisitions of substantial interest (20% or greater) in Australian businesses

- Investments in land and land rich entities

- Investments in agricultural land and agribusiness

- Investments in mining or production tenements, and

- Investments in sensitive businesses including media, telecommunications, transport and various military applications.

The foreign investment controls are significantly relaxed for non-government investors from countries that have a Free Trade Agreement with Australia.

The thresholds that apply to different investments can be found at FIRB’s website firb.gov.au.

12. What are the special rules for larger multi-nationals?

Australia has implemented additional reporting obligations and targeted integrity measures for entities that are Significant Global Entities (SGEs). Broadly, an SGE is an entity which is part of an accounting consolidated group with more than A$1 billion in global annual turnover. SGEs can include large groups controlled by private companies, trusts and partnerships.

These reporting obligations and integrity measures include:

- Lodgement of Country by Country (CbC) reporting, which include lodgement of a Master File, a Local File and a CbC report with the ATO within 12 months of the end of the income year. The Master File and CbC report requirements are consistent with the OECD guidelines. However, Australia has implemented a different format from the OECD format for the Local File, being a transactional data focused XML schema.

- Provision of General Purpose Financial Statements (GPFS) with the ATO where not already filed with ASIC.

- The Multinational Anti-Avoidance Law (MAAL), which is designed to target inbound SGEs which derive Australian sourced income but have structured the arrangements such that the income is earned by a non-resident entity which is not subject to Australian income tax; and

- The Diverted Profits Tax (DPT), which allows the ATO to impose a penalty rate of tax of 40%, plus interest, on profits that are artificially diverted out of Australia through contrived arrangements.

In addition, SGEs are subject to substantial administrative penalties for failing to meet their tax obligations. Late filing penalties for a large number of tax filings could be up to A$782,500 (per return lodged late).

We’re in your corner

From time to time, even the most successful business owners face challenges and unforeseen complications. Having the support of an experienced team is crucial in times of adversity.

Australian Tax Office (ATO) & State Revenue Office (SRO) Audits & Reviews

While ATO and SRO audits are a necessary part of an effective tax system, they can be expensive and disruptive for a business. We can manage the whole process on your behalf, including ATO/SRO and third party communication.

Financial distress

The concerns around solvency can result in both financial and emotional stress for all involved. With the right advice, however, financial distress does not have to mean the end of the business. Our specialist Business Recovery team aims to help businesses in trouble as early as possible, helping them to restructure and trade out of hardship.

Forensic accounting and litigation support

Commercial litigation and other disputes are seldom simple and often involve highly complex issues. Our specialist Forensic Accounting team combines a solid understanding of the litigation process with technical investigative skills to provide support across a range of circumstances including valuation disputes, quantification of losses, family law matters and fraud cases.