One of the most common questions we hear is ‘how can I reduce my tax?’. Most people want to pay as little tax as possible and will often structure themselves in order to achieve this. Unfortunately, there are rules that prevent this from occurring, particularly where artificial arrangements are made to circumvent tax.

The Personal Services Income (PSI) regime is one example of these rules. The PSI regime aims to ensure income earned as a result of an individual’s personal skills or effort is primarily taxed in the name of the individual, no matter what business structure they are operating from.

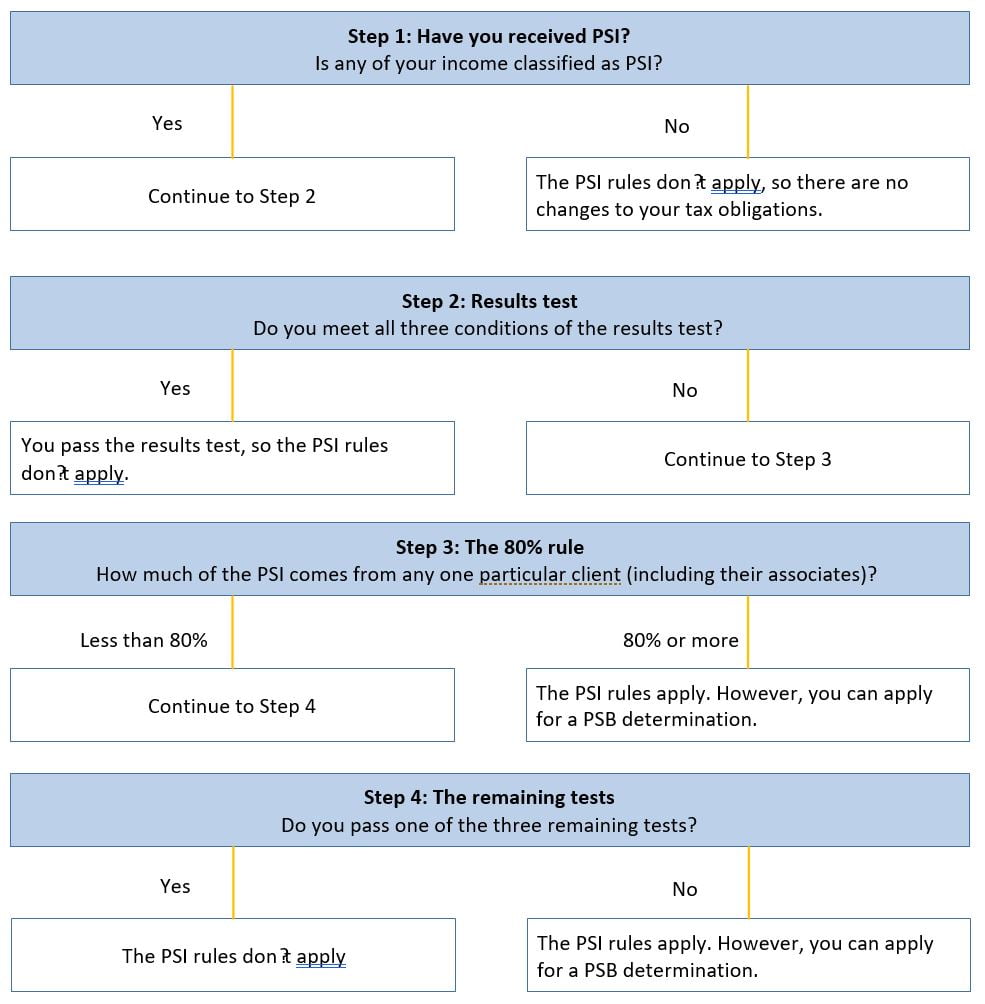

In the event you receive PSI, there are four tests you can apply to determine if you are eligible to be classified as a Personal Services Business (PSB), which will result in the PSI rules not applying to the income you earn. The four PSB tests are:

- Results test

- Unrelated clients test

- Employment test

- Business premises test

Note, tests 2 to 4 are commonly referred to as ‘the remaining tests’ and will only apply if less than 80% of your income is from one client – this is known as ‘the 80% rule.

While there are several tests that can be applied, only one needs to be passed for the PSI rules not to apply. However, they must be applied each financial year and can result in varying results depending on the type of income you earn from year to year.

There are many parts to the PSI regime, so this article has been split into two parts: Part 1 of this article will focus on how the PSI regime works and what is required to pass the results test; and Part 2 will outline what is required to pass the remaining four tests in the event you do not pass the results test.

PSI v PSB – what’s the difference?

PSI and PSB may be two of the many acronyms you have come across in your time ( and really who needs anymore?), however, it is important to understand the difference between them as it can have a significant impact on the overall tax you pay.

Where you are successful in passing one of the PSB tests, you will be able to continue as normal and apply all reasonable deductions against your income. One popular benefit is you can deduct payments to associates for performing non-principal work i.e. bookkeeping, administration and secretarial services (provided these payments are made at arm’s length rates).

One thing to note however, if you are successful in being classified as a PSB, there are restrictions that apply to limit the amount of income splitting you can do.

If the PSI rules do apply to your income, then you effectively ignore the structure that is in place and are taxed similarly to if you were an employee. Several types of deductions that may be available to you as a PSB will be disallowed if you are instead PSI. This concept is known as “PSI attribution” because the income of the structure will be attributed to you, irrespective of whether the money earned has been paid through to you or not.

In short, the tax cost of your activities being considered PSI, instead of PSB, can be significant. Accordingly, it is important that you get it right!

Working out if the PSI rules apply

The first step in determining if the PSI rules apply to you is working out whether any of the income you have received is actually PSI. To do this, you need to review your contracts to ascertain if more than 50% of the income received for a contract was for your labour, skills or expertise. Where this is the case, you will need to continue to work through the PSB tests to determine if the PSI rules will apply.

The following flow chart provides a guide for working through the PSB tests in the order you need to complete them:

Results test

The next step in determining whether the PSI rules apply is working out if you pass the results test. This test is focussed on the nature of your contractual agreements and whether there is any real ‘entrepreneurial risk’ involved. In order to pass this test, you must meet all three of the following conditions for at least 75% of the PSI you receive during the financial year:

- Paid to produce a specific result

- This will generally be the case where:

- You agree with the client upfront on the outcomes and costs

- You only receive payment once a contract is completed

- You are paid to produce a specific number of completed items or activities

- If you are paid an hourly or daily rate or required to submit timesheets, you are likely going to fail this condition

- This will generally be the case where:

- Required to provide the equipment or tools

- You will meet this condition where you satisfy any of the following:

- You are required to supply the tools or equipment to complete the work

- The type of work you are doing does not require any tools or equipment

- The client supplies only minor tools or equipment

- You will meet this condition where you satisfy any of the following:

- Required to fix mistakes at your own costs

- In the event you make a mistake, you must be required to cover the costs of fixing this yourself

- If you invoice your client for the time spent fixing the mistake, you will likely not meet this condition

While the above conditions may not seem all that hard to meet, a recent case highlights the importance of getting it right. In Ariss and FCT [2019] AATA, the taxpayer was an IT specialist in software systems, who provided his services to various large organisations. The taxpayer operated through a trust structure and split his income 70/30 with his wife. The Commissioner audited the taxpayer and issued amended assessments on the basis the income was PSI and he did not meet the results test. The taxpayer took the matter to the AATA and in short, the Judge ruled in the Commissioners’ favour on the basis that the taxpayer was paid on a daily rate, was not liable to cover the cost of fixing any defects in his work and did not supply the tools required to complete the work.

Where to next?

The first part of this article has given an overview on how the Personal Services Income (PSI) regime works and what you need to do to pass the results test for the PSI rules not to apply. Keep an eye out for Part 2 of this article coming next month, which will cover off on the remaining tests.

If you are unsure about whether the PSI rules apply to you or if you pass the results test, get in touch to discuss this further and see how William Buck can help you. As part of our alliance with ACS, we offer members a complimentary review to see how we can assist their business.

Want to hear more in person?

Attend the upcoming ACS Queensland financial structuring seminar, which is offered free for ACS and RCL community members.

When: Wed 11 March, 5.30pm

Where: River City Labs, Level 3, The Precinct, 315 Brunswick Street Mall, Fortitude Valley

Registration essential – visit: https://bit.ly/2RCapTB