With an increasingly strict and frequently changing regulatory environment, there is a growing demand for organisations to provide transparent and reliable financial information to stakeholders.

A high-quality audit means effective and compliant financial reporting

At William Buck, our auditing and assurance services in Australia are tailored to your organisation’s size, nature, and complexity, aligning our service offering to your business goals and inherent risks. We invest in automated technological solutions to drive efficiencies, enabling us to focus on high-risk and complex audit matters. Providing additional support to an audit, assurance solutions enhance the credibility, compliance and reliability of your financial reporting.

A consultative culture and relationship-driven approach

We are in it for the long haul — our relationships are based on trust and transparency, from our client focus to our people, whom we value and aim to nurture and develop.

Operating within an integrated, full-service firm of accountants and advisors, our auditing and assurance services are founded upon the expertise of specialists from across Australia and New Zealand. Our Praxity Alliance membership enhances our ability to give our clients a global reach across 120 countries.

Public entities

William Buck is a trusted assurance and audit specialist in the Asia-Pacific region. We provide accurate, reliable and transparent service to our high-profile clients — some of Australia’s most recognised public companies — who rely on investors’ support and the efficient operation of capital markets.

Private entities

From some of Australia’s largest private companies and trusts to startups and family offices, our private clients depend on us for specialised industry knowledge and as a strategic sounding board. Our audit and assurance services are sensitive to our private clients’ relationships with their financial reporting stakeholders.

Internal audit

An internal audit should offer more than regulatory compliance. It should assist in achieving efficiency and excellence in business performance by ensuring the right balance of controls. This balance will support innovation without causing disruption and adequately address risks without creating inefficiencies.

Explore Audit & Assurance Services

External Audit

Effective external audits contribute to decision-making, minimize risks, and focus on achieving the best results for your business, ensuring future success and informed management decisions.

Financial Reporting Accounting & Advisory

Our national technical division assists organizations in implementing various regulations, ensuring legislative compliance and effective financial reporting amidst a rapidly changing regulatory landscape.

Fraud Investigation & Prevention

Our expert team combines forensic accounting, internal audit, and risk management to protect your business from fraud, safeguarding its reputation and overall value beyond the bottom line.

Internal Audit

Our outcome-oriented internal audit service goes beyond regulatory compliance, tailoring to your business needs and helping achieve efficiency, excellence, and overall objectives for improved business performance.

IT Assurance

Our Australasian IT Assurance team partners with you to maximize the value of your information and IT investments, while effectively managing risks in the ever-advancing world of technology.

Risk Management

We help organizations establish sustainable 'end-to-end' risk management programs, identifying, assessing, and prioritizing interdependent risks across all areas to address uncertainty and enhance decision-making for improved overall performance.

Sustainability Reporting

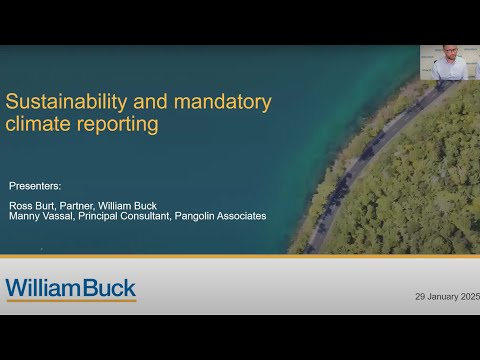

Australia’s new sustainability reporting framework is now in effect and requires certain entities reporting under Chapter 2M of the Corporations Act 2001 to prepare a sustainability report which includes climate-related financial disclosures in accordance with Australian Sustainability Reporting Standards (ASRS) made by the Australian Accounting Standards Board (AASB).

Transparency Report

Transparency Report

Our Transparency Report documents our legal, governance and ownership structures and effective internal quality management systems and highlights our independence policies and procedures.

Financial Reporting Resources

A guide to the new rules for liability classifications

What you need to know about changes to the classification of liabilities as current or non-current.

Relationships that matter: a practical guide to related party transactions

Explore our practical guide to understanding related parties – who they are, what constitutes related party transactions and the responsibilities of management in identifying and disclosing them.

Changes to disclosure of accounting policy information in financial statements

Read more about the recent changes to the disclosure of accounting policy information in Australia.

Going concern publication

In today’s changing economic climate, the assessment of going concern has become a critical assessment for many entities. This practical guide will help you produce a high-quality going concern assessment.

Sustainability Resources

Webinar: Sustainability & mandatory climate reporting requirements

Audit & Assurance Specialists

Latest insights from our Audit & Assurance team

Do you have a question you'd like us to answer?

Send it through and we’ll get it to the right person.

Get in touch